dependent care fsa rollover

By Hayden Goethe A dependent care flexible spending account lets participants set aside pre-tax dollars. 2850 in 2022 and.

Flexible Spending Accounts Mychoice Accounts Businessolver

Removes the limit for what people with dependent care FSAs can roll over in 2021 and 2022.

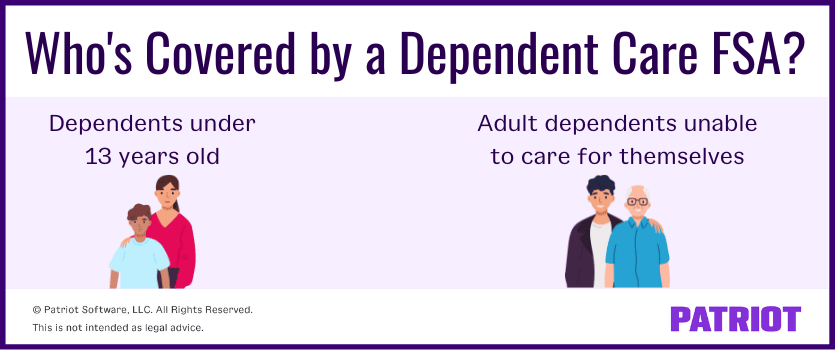

. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. On March 27th 2020 the US. The latest Covid relief bill removes the limit on dependent care FSA rollovers in 2021 and 2022.

5000 for a married couple filing jointly or 2500 for each individual FSA if you each have a separate account. See the table on the next page for more information on how to access your FSA account. Here is my situation.

IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that. The American Rescue Plan increased the 2021 dependent-care flexible spending account limit to 10500 from 5000. If you and your spouse are divorced only the parent who has custody of the child reThe Federal Flexible Spending Account Program FSAFEDS offers an app to helThe money in your FSA can only be used for expenses for.

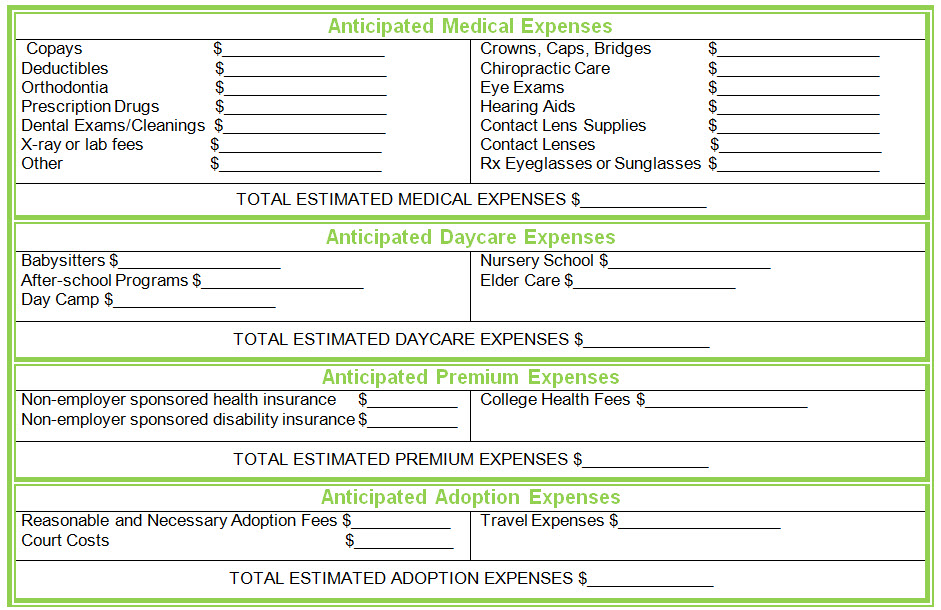

Your Dependent Care FSA can reimburse you for expenses paid to a babysitter under the age of 19 as long as the babysitter is not the participants child stepchild foster child or tax. What is a dependent care FSA. A Dependent Care FSA is a tax-advantaged benefit account offered through an employer.

IRS Notice 2021-26 issued May 10 clarifies that if dependent care flexible spending account funds would have been excluded from participants income if used during. Companies may allow FSA rollovers into 2022 but. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could.

You can spend your dependent care savings account funds on a wide. By signing up for one an employee can contribute up to 5000 annually pre-tax to help cover the. Posted 2022-08-09 August 9 2022.

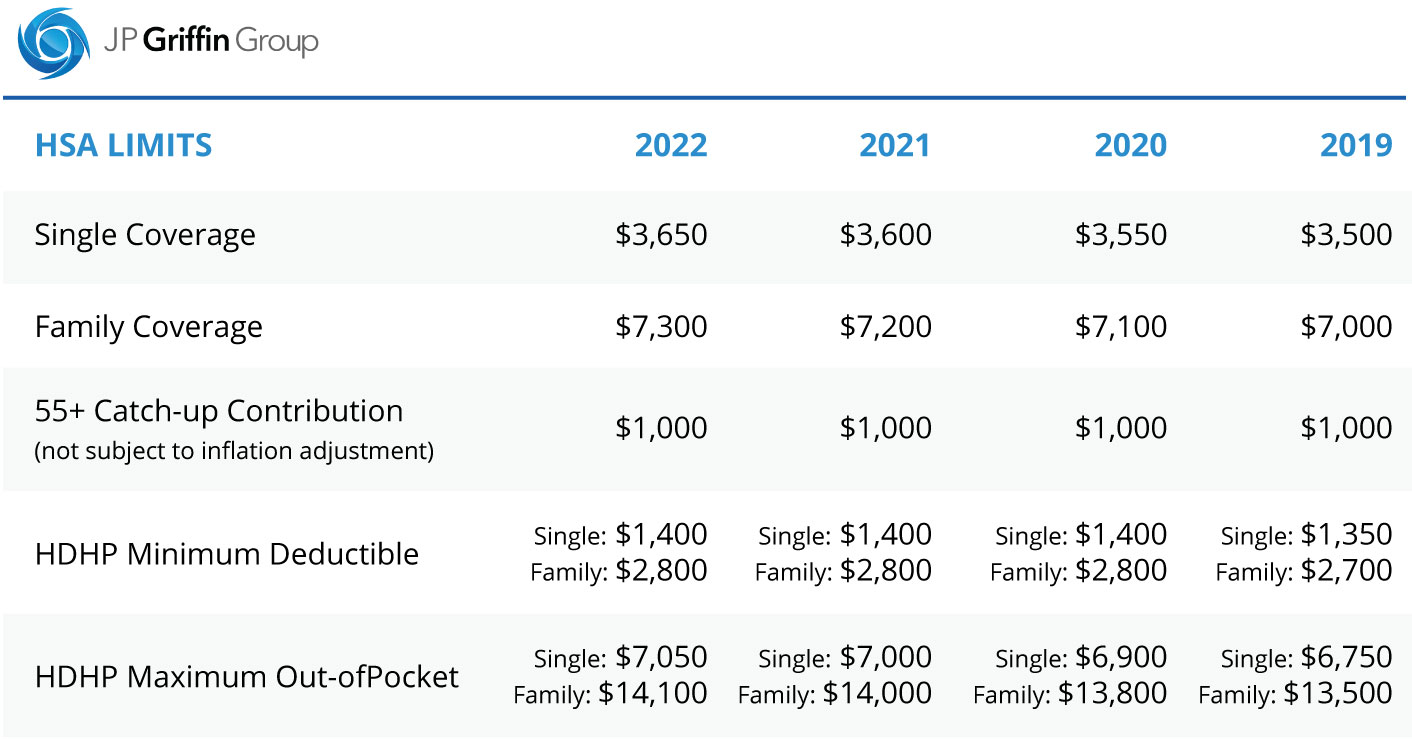

So my total DC FSA available for 2021 was. An FSA is a pre-tax fund that employees can contribute to and use when needed. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing.

A Dependent Care Flexible Spending Account FSA lets you save on dependent care expenses using pre-tax dollars. The maximum amount you can contribute to an FSA in 2021 is. Many employees with children or elders who require daytime supervision have no choice but to pay for expensive dependent care services so they can go to work.

Beginning 112021 you can rollover up to 550 of your previous years FSA unused balance. A dependent care flexible spending account is a type of flexible spending account FSA. A flexible spending account lets individuals put aside pretax dollars to cover qualified medical expenses.

The Savings Power of This FSA. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Dependent Care Flexible Spending Account FSA.

A dependent who is younger than 13 See more. You are now able to roll over remaining funds into your next plan year up to 20 of the. I did have DC FSA withheld from my wages in 2021 for 1200 and I had a rollover from 2020 to 2021 of 2550.

Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses. Department of Treasury changed the policy on remaining funds in FSAs. Dependent Care FSA.

Flexible Spending Accounts Department Of Administrative Services

Fsa Carryover Everything You Need To Know About This Feature Bri Benefit Resource

Flexible Spending Accounts Uk Human Resources

Flexible Spending Accounts Fsa Pro Flex Administrators Llc

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Fsa Dependent Care Everything You Need To Know

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Flexible Spending Accounts Fsa State Employee Health Plan

Flexible Spending Accounts Fsa The City Of Portland Oregon

Irs Covid 19 Fix For Workplace Health And Dependent Care Flexible Spending Accounts Mid Year Changes Now Allowed

New Flexible Benefits Max Amounts For 2022 Workest

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Good News For Associates Participating In Flexible Spending Accounts The Exchange Post