louisiana estate tax rate

Services subject to sales tax include hotel accommodations printing laundry telecommunications and the repair of tangible property. This interactive table ranks Louisianas counties by median property tax in dollars percentage of home value and percentage of.

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

The average effective rate is just 051.

. Sales Taxes like most states Louisiana has both a state and local sales tax. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Louisiana has recent rate changes Tue Oct 01.

The first step towards understanding Louisianas tax code is knowing the basics. Louisiana collects a state income tax at a maximum marginal tax rate of spread across tax brackets. In Louisiana theres a tax rate of 2 on the first 0 to 12500 of income for single or married filing taxes separately.

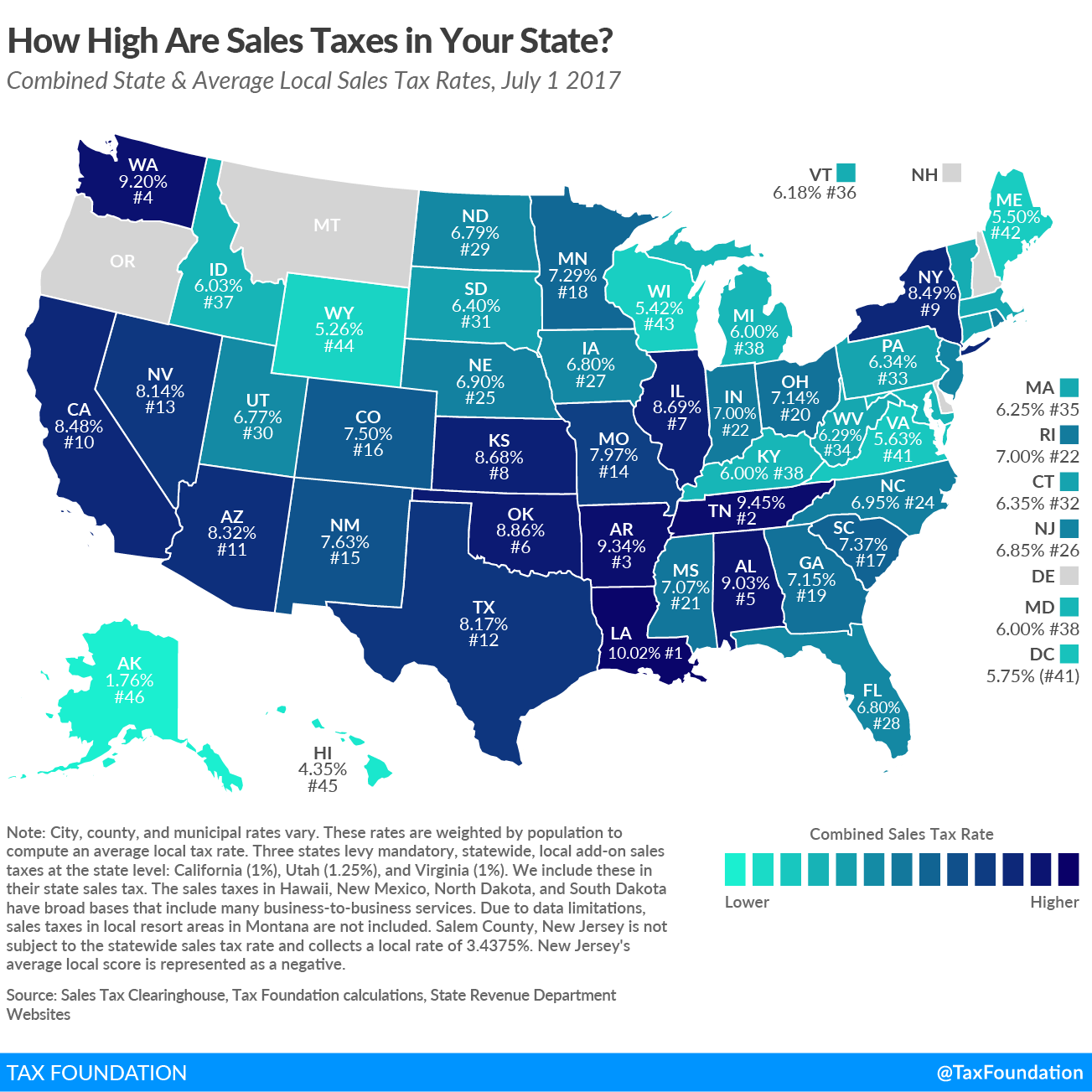

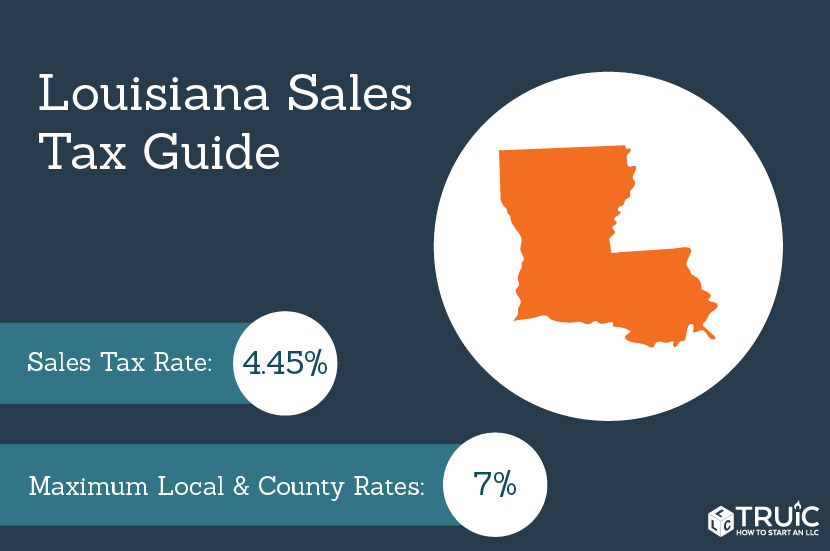

However because of the varying tax. Its state sales tax is 445 and its local sales tax has an. 31 rows The state sales tax rate in Louisiana is 4450.

Such estates or trusts may elect to be taxed at the rate of five percent on total gross income from Louisiana sources. There is also the Louisiana. Louisiana has the fifth lowest property tax rates in the nation.

Rate and basis for assessing property values The rate used in determining assessed value differs depending on the type of property. How does Louisiana rank. Returns and payments are due on May 15th of each year on.

On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832. Below we have highlighted a number of tax rates ranks and measures. With local taxes the total sales tax rate is between 4450 and 11450.

From Fisher Investments 40 years managing money and helping thousands of families. The average effective rate is just 053. If youre married filing taxes jointly theres a tax rate of 2 from 0 to.

The average effective rate is just 053. Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State. Located in southeast Louisiana adjacent to the city of New.

Like the Federal Income Tax Louisianas income tax allows couples filing jointly to. The Economic Growth and Tax Relief Reconciliation Act of. Counties in Louisiana collect an average of 018 of a propertys assesed fair market value as property tax per year.

The following types of property are. Louisiana has the third lowest property tax rates in the nation. Median property tax is 24300.

There is also the Louisiana homestead exemption for anyone who. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average.

Groceries utilities and prescription. Louisiana has one of the lowest median property tax rates in the United. Sales and Property Taxes in Louisiana.

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Sales Tax Rate By State Income Tax Map Property Tax

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana La Tax Rate H R Block

Paradym Fusion Viewer Real Estate Trends Realtor License Outdoor Structures

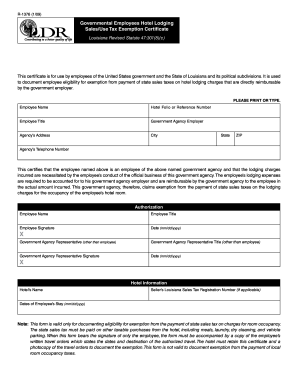

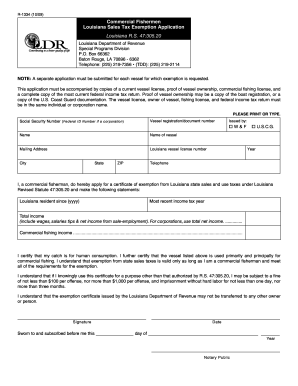

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Sales Tax Small Business Guide Truic

America S 15 States With Lowest Property Tax Rates House Prices Louisiana Homes Property Tax

Louisiana Property Tax Calculator Smartasset

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Historical Louisiana Tax Policy Information Ballotpedia

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Property Tax Calculator Smartasset

Louisiana Inheritance Laws What You Should Know Smartasset

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax